How Auto Insurance Quotes Work (In Plain English)

An auto insurance quote is simply an estimate of what you’ll pay for a specific set of coverages. You share a few details who drives, what you drive, and where you live and insurers run that information through their rating systems to predict risk. The result is a price for the coverage limits and deductibles you select. Change the coverage (for example, raise liability limits or add comprehensive), and the quote updates. Quotes aren’t binding until you finalize a policy, but they’re the fastest way to see how protection levels affect your budget.

“A quote is an estimate for specific coverage keep limits and deductibles the same across companies to compare fairly.”

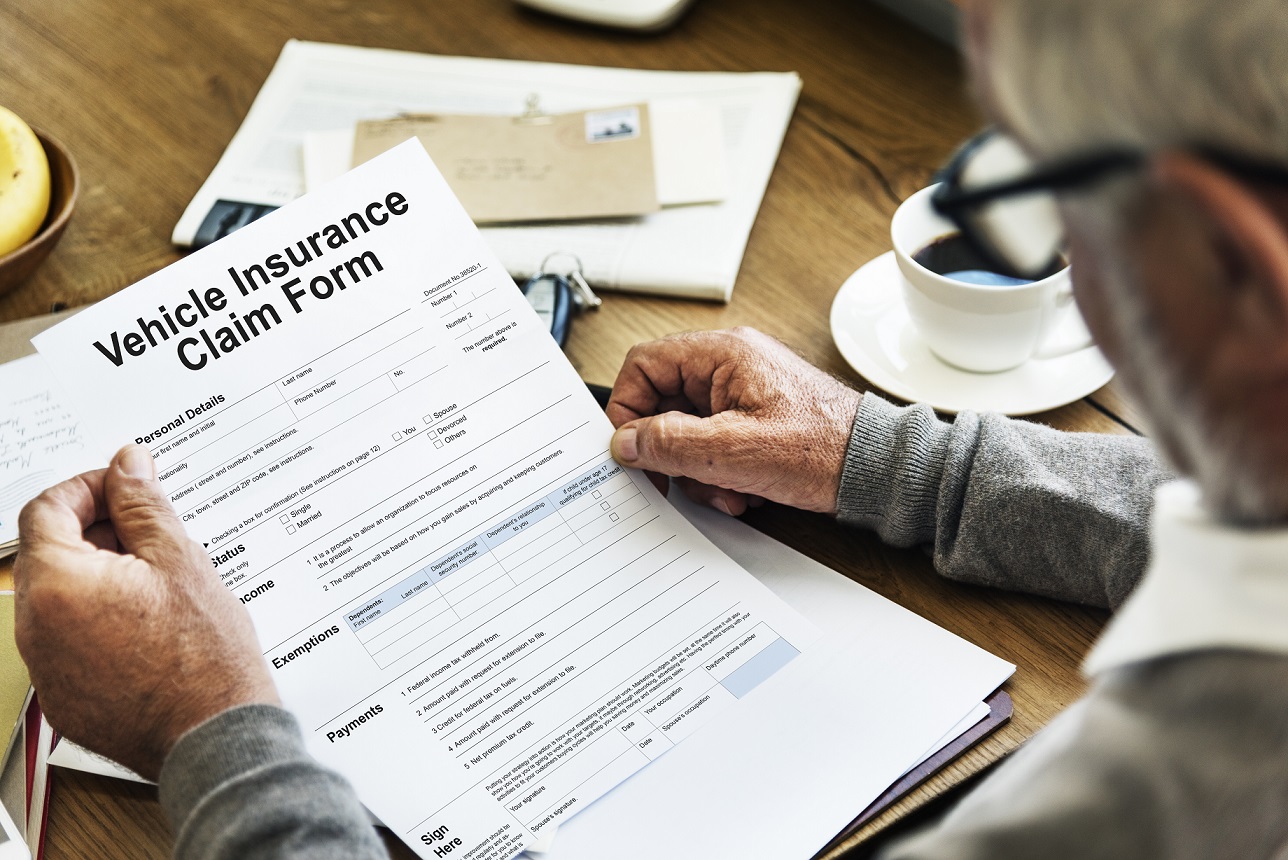

What shapes your price? Common factors include your driving history (tickets, claims), vehicle details (year, model, safety features), annual mileage, garaging address, and the coverages you choose. Your deductible matters too: higher deductibles usually lower your premium, while lower deductibles raise it but reduce out-of-pocket costs if you file a claim. Discounts can also make a difference think multi-car, good driver, homeowner, good student, or paying in full. Because each insurer weighs these inputs differently, it’s normal for quotes to vary.

How to compare like a pro: pick your target coverage (for example, 100/300 liability, $500 collision and comprehensive deductibles), then request quotes using that exact setup from each company. Review the declarations carefully are roadside, rental reimbursement, or gap coverage included or optional? Check billing options and fees, and verify available discounts you qualify for. When you’re ready, lock in your choice and confirm effective dates so there’s no lapse in coverage. If you need help translating the fine print, QuoteWheels is here to explain it in plain language and help you choose with confidence.